Step one in managing your finances is to know what you’re spending. It is futile trying to save if you don’t have an accurate representation of where your money is going. Once you know where you are spending your money it will allow you to focus where you should redirect your efforts to make some improvements.

Step 1 – Set up your budget spreadsheet.

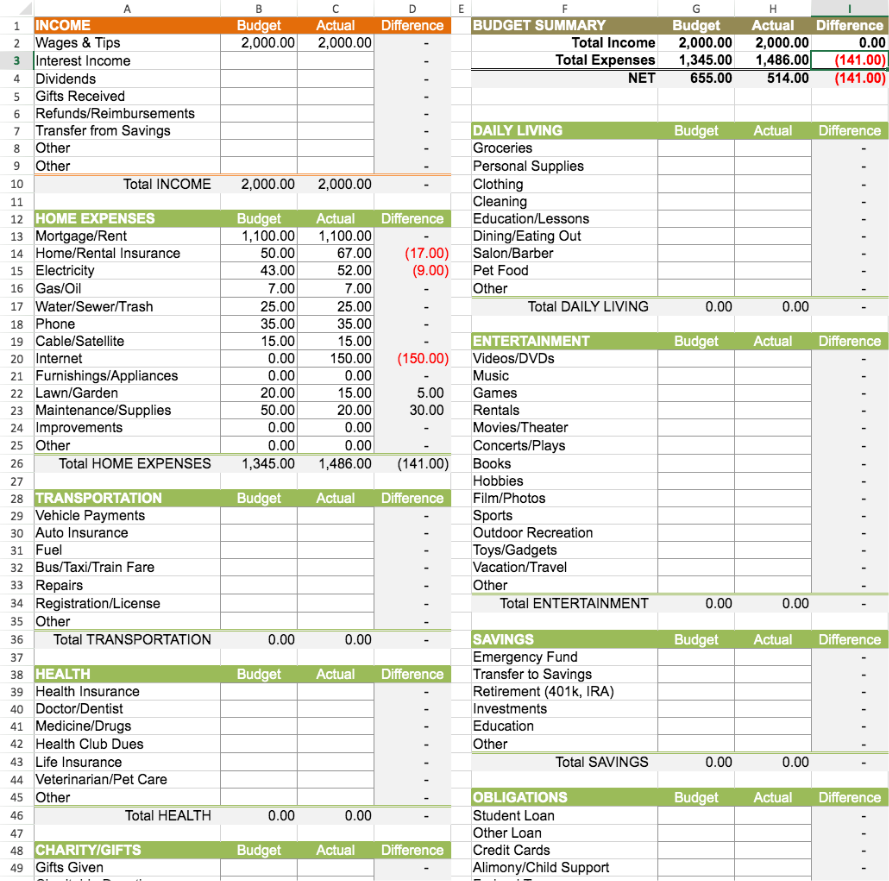

You need somewhere to store your long term logs of your spending. You can download or buy sophisticated apps or you can use a spreadsheet. You need to be able to capture spending over days / weeks / months to allow you to plan for upcoming events and for you to see where you can tweak your habits to improve your cashflow.

These systems can get super complicated if you’re an expert. Spreadsheets are very powerful but this can be daunting for a new user. I’ve created a couple of free sheets that you can use to start with and are simple enough for everybody to use. Click here for the free sheets.

If you want more sophisticated sheets click here to purchase.

Categorize your spending. When you’re running a home you probably have a few hundred different transactions a month. We want to see the big picture, not all of the little transactions. You can probably categories these up into about 20 or 30 categories for the year.

Step 2 – Log your spending

Save all of your daily transactions and enter into spreadsheet / application at the end of the day.

- Save all receipts from transactions you make during the day.

- Pay by debit card if possible so you transactions will be logged for you into your banking app.

- Carry a notepad or use a note app on your phone to make a note of each cash transaction you do during the day that doesn’t have a receipt.

Simple phone apps that are useful for this are your phones camera (to take a photo of receipts), Google Keep, Microsoft Onenote, Apple Notes.

Step 3 – Log your spending into your long term tracker.

At the end of the day gather your daily log and put these numbers into a spreadsheet or budgeting app. This is where the real power of budgeting starts to benefit you. You will start to see patterns and you can plan for upcoming bills. If you have a good filing system you can do this step at the end of the week. Just gather all of your receipts and weekly log together and enter into your system in one go. It takes about 10 minutes a week once you’re used to it.

Step 4 – Set up your budget.

After a few days / weeks / months you will start to see a picture of where your money is being spent. This allows you to prioritize spending that is essential and maybe trim spending where you might be spending too much.